How To Quickly Pay Off Credit Card Debt When You Have No Money

9 Min Read | Apr xiii, 2022

If you've got credit bill of fare debt, it can experience similar the life is being drained from your income every month. Purchases from months ago are haunting y'all and holding yous back from doing what y'all want with your coin today.

Nosotros get it. We've felt the weight debt tin can put on you lot. And. It. Sucks.

The good news is, it doesn't have to stay like this. Use the tips and info hither to acquire how to pay off credit menu debt. Put this month'due south income back into this calendar month. And so you tin can start putting more of it toward the future you want.

How to Pay Off Credit Card Debt Fast: 7 Tips

Hither are our seven favorite, time-tested and proven ways to pay off credit card debt:

1. Get on a upkeep.

Money goals can't become money realities without a budget. Why? A budget is a plan for your money—Every. Single. Dollar. If y'all don't plan out where your coin is going, you'll never know where it went. You'll never exist able to tell it exactly where to go.

You tin pay off debt faster! Go started with a Free trial of Ramsey+.

And y'all desire to tell your money to get toward paying off credit bill of fare debt, right? So, go on a budget!

Kickoff by listing your income (everything coming in). Then write out your expenses—starting with your Iv Walls (food, utilities, housing and transportation). You can put in your other expenses afterwards that.

One time y'all've got all your expenses accounted for, decrease them from your income. If you have money left over, put information technology to use paying off credit card debt! If yous've got a negative number, it'southward time to tighten upward those other budget lines until you get a zip-based budget. (That ways your income – expenses = zero.)

Okay! At present you've got a budget. How can you make it work for you on the credit carte du jour debt payoff journey? Keep reading!

2. Stop using your credit cards.

If you lot desire to go out of credit card debt, information technology's fourth dimension to break up with your credit cards. And you don't accept to have a nice dinner or a large chat with them. Only put them on the tabular array and say, "Information technology's not me—information technology's you . . . You're bad for me, my finances and my future. Good day." And never expect dorsum.

If you stop using credit cards, you'll never run the take a chance of having a credit carte du jour balance. Ever. Over again. Start using a debit carte and cash—your own real money—when y'all pay for things.

iii. Save a $1,000 emergency fund.

If getting rid of those credit cards freaks you out because you use them as an emergency fund, and then go yourself an actual emergency fund as fast every bit possible.

Salvage $1,000 quickly. Go out it in savings as a buffer between you and those "life happens" moments. And trust us, it'southward way better than a credit menu. If you lot take an emergency and pay cash, you won't be charged interest. Blast.

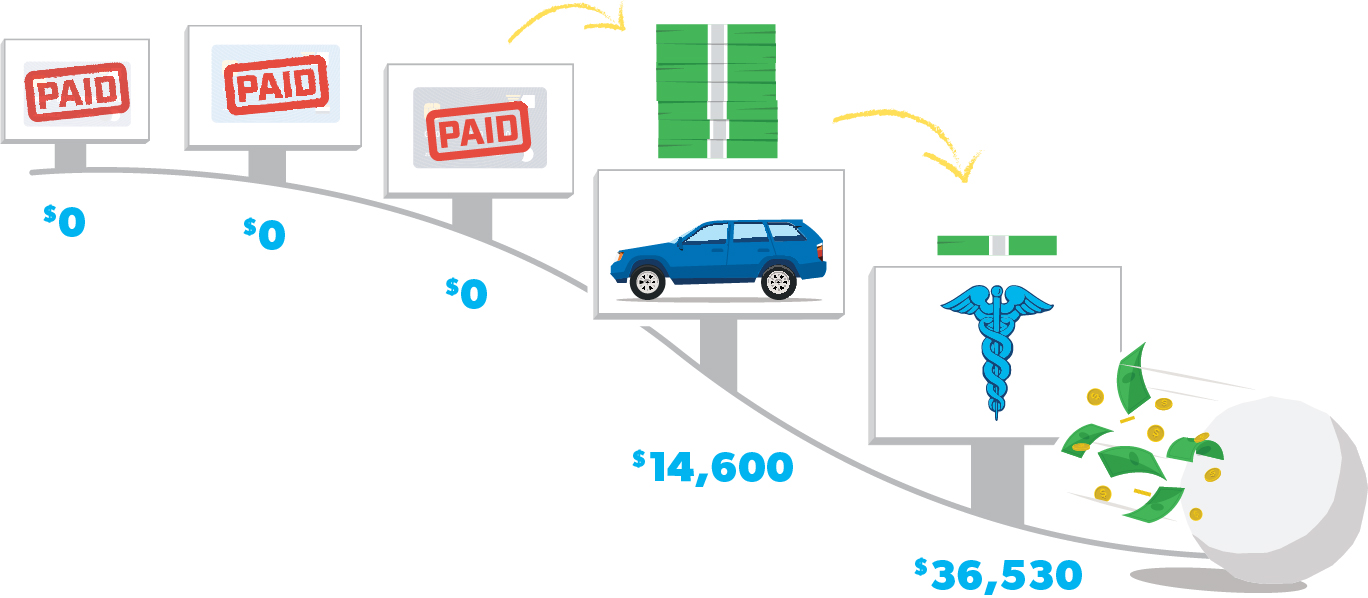

4. Utilise the debt snowball method.

Use the debt snowball method and start paying off your credit cards smallest balance to largest. Okay, we know you lot're thinking about those interest rates correct now. But what you really need is a win. You demand 1 of those credit cards gone. Speedily.

The debt snowball method is all most building your motivation and momentum by attacking one credit carte du jour debt at a time—and going after the one you can go out of your life soonest start. That quick win is super inspiring and key to getting out of debt.

(Learn the exact steps to the debt snowball method in the What Is the Quickest Way to Pay Off a Credit Carte du jour? section below.)

Okay, so how do yous assail each credit card? You need to complimentary up more money or start making more than. The adjacent tips testify y'all how!

five. Lower your bills.

Cutting back on your spending with those regular monthly bills is a dandy identify to outset freeing up cash to put toward paying off debt! Y'all tin practice this past beingness more intentional with your electricity use, meal planning, buying generic—and then many other ways.

You lot're near to feel like y'all got a raise. So, make certain you're also intentional about putting this freed-up coin toward debt—not wasting it on unnecessary purchases!

6. Sort your priorities and driblet some expenses.

Okay, it's fourth dimension to get a little radical. Are you ready? (Aye. Yes, you are.)

Look back at that budget. Yous trimmed it up. Now cut off some branches. It might hurt, but if you lot can take sure expenses out of your budget completely, that'southward the real money saver.

What extras tin can you live without in this season? (And information technology's just a season, we hope!) Information technology's not goodbye—information technology's see y'all afterward.

Here are some mutual unnecessary budget lines you can delete (for now): restaurants, amusement, subscriptions you don't apply regularly, cable, trips to the coffee shop. Be honest with yourself and your upkeep. What things can y'all live without while you're paying off that credit card debt?

You aren't cutting all the fun. Just get creative with budget-friendly fun and rewards! Hey—these sacrifices right at present will make a huge difference for your future.

vii. Make extra income.

With this tip, y'all aren't freeing upwardly and redirecting cash that'due south already in your budget—you're putting more coin into the upkeep. Get yourself a side hustle! Bulldoze for Uber or Elevator. Deliver groceries with Shipt or Instacart. Resell your stuff with Poshmark or eBay.

Use the skills you lot have and tutor, give lessons, take freelance gigs. Yous don't even accept to leave your burrow. There are plenty of work-from-home jobs you tin can pick up total time (and salve money on gas and the commute!) or role fourth dimension.

This is an investment of your fourth dimension that pays off big. Footstep into the hard piece of work—and make some awesome progress on paying off your credit carte du jour debt.

What Are Other Credit Card Repayment Methods—and Practise They Work?

Await, paying off debt is never easy. And in that location'southward a lot of fizz surrounding the idea of "quick ways" to get rid of your debt. Here's the truth: At that place's no quick fix. Those tips we just mentioned are the tried-and-true route.

Simply we don't want to leave you in the night. Let'due south take a look at the most-advertised ways to reduce debt—and talk about why they're so crappy.

- Debt Consolidation . This is basically a loan that combines most of your debts into i single payment. This sounds similar a good idea until you realize the life-span of your debt grows, which means you lot're in debt longer. And the low interest rate that sounded and then good at starting time unremarkably goes up over fourth dimension.

- Debt Settlement. Debt settlement companies will accuse you a fee and promise to negotiate with your creditors or reduce what yous owe. But typically, they but take your money and leave yous drowning in the debt yous already had—plus all the new late fees from when no one (no. ane.) was paying on your balance.

- Debt Avalanche. Dissimilar the debt snowball, the debt barrage is a debt reduction method that focuses on paying off the credit carte du jour with the highest interest rates first. The problem with this method is rooted in motivation. Remember: Paying off debt is less about math and more nearly behavior. With the debt barrage, your first targeted debt might have a long time to pay off. Your motivation volition burn down out faster than a short-wicked candle. You need quick wins to encourage yous to keep going! The debt avalanche takes likewise darn long to see existent progress.

- 401(k) Loan. Never borrow from your 401(chiliad) to pay off your debt. We repeat—never infringe from your 401(1000)! Not only volition you go striking with penalties, fees and taxes on your withdrawal, but yous're besides stealing from your own future.

- Habitation Equity Loan. Also known as a HELOC, this kind of loan borrows against the equity you've built up and puts your house upward equally collateral. In other words, a HELOC trades what you actually ain of your home for more debt—and puts you at chance of losing your firm if y'all can't pay dorsum the loan on fourth dimension. Don't become a HELOC. Period.

- Credit Carte du jour Residue Transfer . This is when y'all move all your credit card debt into one new credit card. Y'all'll become hit by transfer fees and risk going blind reading the fine print. Okay, that's an exaggeration—but there's no exaggerating that a huge spike in interest rates will hit you like a ton of bricks if yous brand one late payment. This is trading a agglomeration of bug for one bigger problem. Don't. Do. Information technology.

These debt reduction strategies are risky and really simply treat the symptoms. You don't demand to consolidate, settle or borrow more coin to bargain with your credit card debt. You do need to change how you lot manage your money (using all those tips from in a higher place!).

What's the Flim-flam to Paying Off a Credit Card Quickly?

We already mentioned the quickest (and best) way to pay off credit card debt is the debt snowball method. And this is how you do it:

Step 1:Listing your credit card debt from smallest to largest. (Recall: Don't worry about interest rates correct now.) Pay minimum payments on everything simply the smallest one.

Step ii: Utilise all the extra money you've got from those before tips and attack the smallest credit card debt with a vengeance. Once that debt is gone, take what y'all were paying on it and apply it to the 2nd-smallest debt (while still making minimum payments on the rest).

Pace three:Once that credit card debt is gone, take what y'all were paying on information technology and apply it to the next-smallest debt. The more than you lot pay off, the more than your freed-up money grows and gets thrown onto the adjacent debt—like a snowball rolling downhill. It'due south unstoppable. You're unstoppable. That credit card debt doesn't stand a chance.

Continue repeating those steps until the debt is completely gone. And don't forget to close your credit card accounts later on you pay them off. Then go ahead and dance like nobody's watching, fifty-fifty if they are. You did it!

Okay—so all of this takes endeavor, sacrifice, focus and time. What if you could speed information technology upward even more? Learn the plan to do just that in Financial Peace University—available only in Ramsey+. The average household pays off $v,300 in the showtime 90 days of working this plan. Imagine your life ninety days from at present with at least $5,300 of your credit carte debt gone. Forever. Check it out in a Ramsey+ complimentary trial!

You've got what it takes. Use these tips, jump into the debt snowball method, try out Ramsey+, and don't give up.

Don't. Give. Upward.

About the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/debt/how-to-pay-off-credit-card-debt

Posted by: wesleyhiscired.blogspot.com

0 Response to "How To Quickly Pay Off Credit Card Debt When You Have No Money"

Post a Comment